Welcome to CV TRADE

Consulting is a long-term investment in your goal’s future.

View consulting as a long-term investment in the future of your goals. It's a strategic partnership that nurtures success over time.

About us

We are the magic behind the company’s best days.

CV Trade is a pioneering research advisory having a team of specialized financial market analysts having massive experience in carrying out capital market research.

Our Services

The largest truly global wealth manager

Equity Cash

Equity cash refers to the cash component of an investment portfolio that's allocated towards equity-based assets, such as stocks or equity mutual funds. It's a crucial element within a diversified investment strategy, offering potential for growth and returns through ownership in companies or funds focused on stocks.

Stock Options

Stock options are financial instruments that grant the holder the right, but not the obligation, to buy or sell a specific stock at a predetermined price within a certain timeframe. These options are contracts traded on exchanges and can be used for speculation, hedging, or earning income.

Index Options

Index options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying stock index at a specified price (strike price) on or before a predetermined expiration date. Unlike stock options, which are based on individual stocks, index options are based on stock market indices.

Insurance

Insurance is designed to provide financial protection and mitigate risks associated with unforeseen events or losses. Insurance plays a critical role in financial planning by providing a safety net against unexpected events, offering peace of mind, and helping individuals and businesses manage risks effectively. It acts as a means to protect against potential financial losses that could otherwise be financially devastating.

SIP

SIP stands for Systematic Investment Plan, which is an investment strategy offered by mutual funds. It allows investors to regularly invest a fixed amount in a mutual fund scheme at predetermined intervals, usually monthly or quarterly. SIPs are popular among investors looking for a disciplined and long-term investment approach.

Mutual Fund

A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities managed by a professional fund manager. Investors buy shares in the mutual fund, and the fund's value, known as Net Asset Value (NAV), fluctuates based on the performance of its underlying assets.

0

+

Happy Customers

0

Team members

0

%

Absolute Returns

0

+

Years of Experience

Why Choose Us

Connecting businesses, ideas, and people for greater impact.

Linking businesses, ideas, and individuals for amplified impact. Together, let’s create a meaningful difference.

Smart Solutions

Smart solutions for today's challenges, shaping a better tomorrow.

High Conversions

Unlock high conversions through strategic solutions and targeted approaches.

Certified Expert

We have a team of certified expertise you can trust for assured excellence.

24/7 Premium Support

Experience round-the-clock premium support for your utmost convenience and peace of mind.

Strategic consultants, experts in accelerating change for business and individuals.

Strategic consultants: catalysts for accelerating change in both business and individual trajectories. Our expertise drives transformative growth.

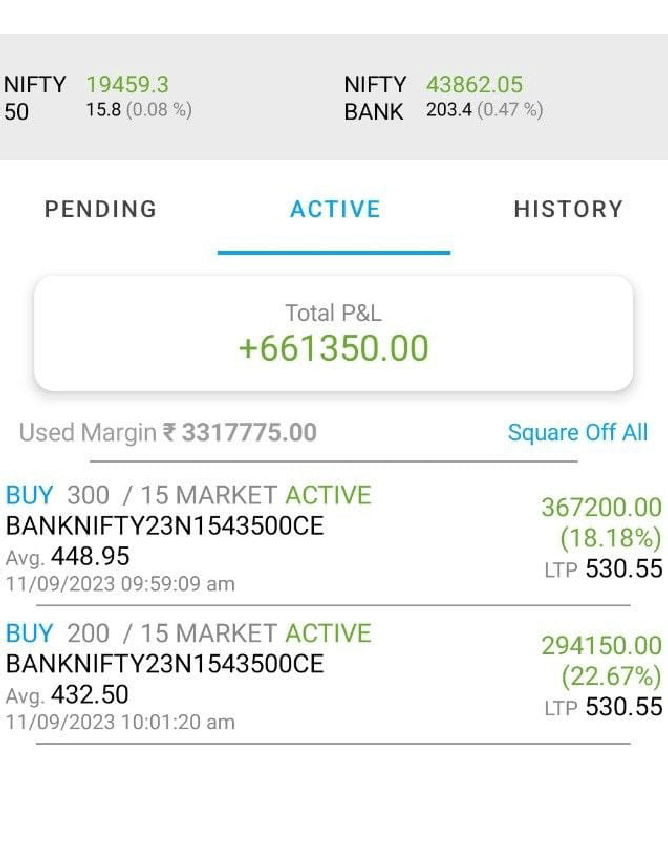

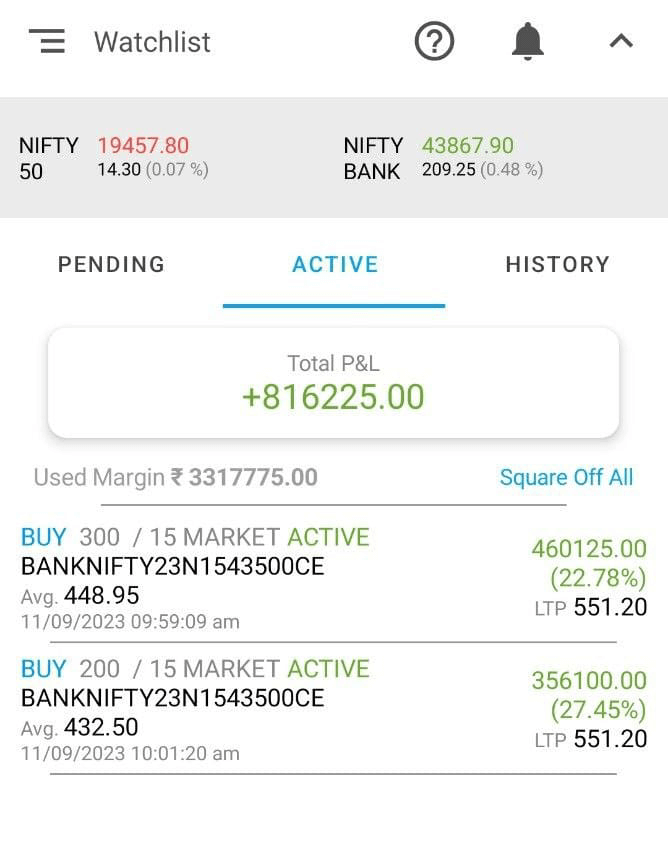

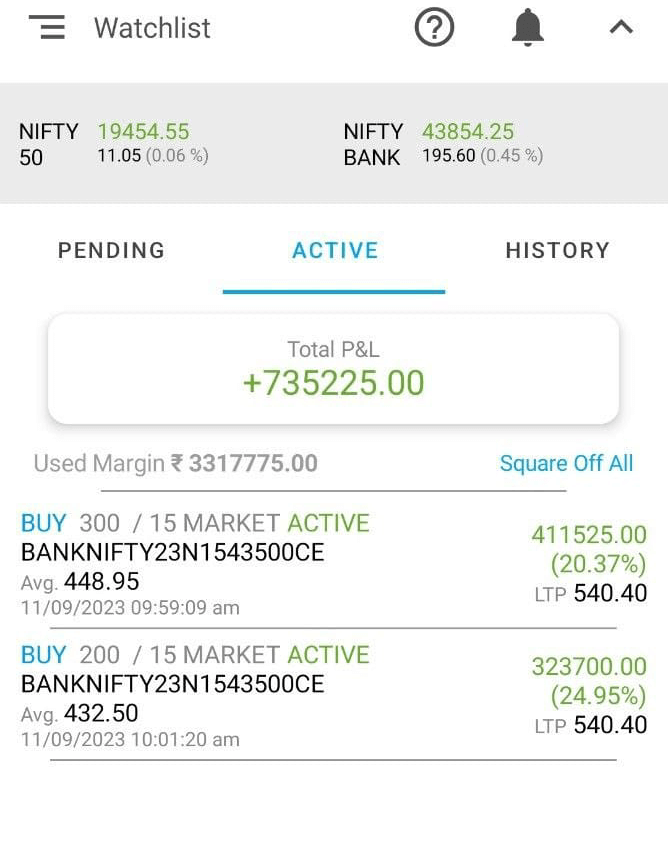

Gallary

Most Popular Questions

Pricing

Starter Pack

Upgrade, Downgrade or Cancel anytime

20%

Monthly Service

- Actual Investment

- 100% Profit

- Latest Updates

- Dedicated Manager

Upscale Pack

Upgrade, Downgrade or Cancel anytime

25%

Profit Sharing

- Below One Lakh 35%

- Above One Lakh 30%

- Above Five Lakh 25%

- Dedicated Manager – Free

Enterprise Pack

Upgrade, Downgrade or Cancel anytime

100%

Portfolio Management

- Depends on investment

- 100% Profit

- Buffer Funds

- Dedicated Manager – Free

Send us a message

We’re here to answer any questions you may have and create an effective solution for your instructional needs.

Copyright 2025 © CV Trade & Stcok Research LLP

Disclaimer: stock market is subject to profit and loss. We provide calls for educational purposes only so before investing concern with your financial advisor.